Accountants see bigger hiring and pay boosts

Accounting Today

FEBRUARY 20, 2025

Hiring and salaries grew more quickly for accountants than any other job group last year, according to a new report.

Accounting Today

FEBRUARY 20, 2025

Hiring and salaries grew more quickly for accountants than any other job group last year, according to a new report.

Basis 365

FEBRUARY 17, 2025

If youre growing your business, your financial leadership is essential for sustainable success. However, not every business has the capacity or budget to hire a full-time, in-house Chief Financial Officer (CFO) or Controller. Thats where fractional financial professionals come in. But whats the difference between a fractional CFO and a fractional Controller, and which role would your business benefit from the most?

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AccountingDepartment

FEBRUARY 19, 2025

Accounting disruptions can strike without warning. Whether its a provider suddenly shutting down, platform glitches, or other unforeseen issues, these disruptions can leave your business scrambling. With cases like the sudden closure of Bench, which left businesses without their books, its more apparent than ever that entrepreneurs and business owners need a plan to safeguard their financial processes.

Accounting Today

FEBRUARY 18, 2025

The rise of generative AI has led to AI-guided cheating, and accounting educators are seeing it in their own classrooms.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Mark Lee

FEBRUARY 18, 2025

Trust has always been the foundation of strong client relationships. But in a world where AI and large language models (like ChatGPT) are becoming increasingly popular, the need to show clients they can trust you has never been more important. Clients have long had the facility to search online and to access instant answers, generic advice, and now also have automated solutions at their fingertips.

Insightful Accountant

FEBRUARY 20, 2025

In this insightful episode, host Gary DeHart sits down with HR expert Michelle LeBlanc to explore key HR strategies for accountants and professionals in regulated industries like finance, healthcare, and energy.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

FEBRUARY 20, 2025

The report reveals that mid-sized (21-50 employees) and large firms (over 200 employees) are leading AI adoption.

AccountingDepartment

FEBRUARY 20, 2025

In the fast-paced world of entrepreneurship and business management, the importance of maintaining impeccable financial records cannot be overstated. Accounting and controller services are the backbone of a well-oiled business machine, guiding entrepreneurs toward clarity and strategic growth.

Menzies

FEBRUARY 17, 2025

Menzies LLP - A leading chartered accountancy firm. Would you risk it for a chocolate biscuit? We talk about risk a lot, from insignificant choices about what to eat through to decisions which can have a monumental impact on our lives and our businesses. We are often warned off from thinking it wont happen to me, but human nature can lead us to avoid dwelling too much on the negative as it can have a debilitating impact if not kept under control.

RogerRossmeisl

FEBRUARY 16, 2025

When deciding on the best structure for your business, one option to consider is a Ccorporation. This entity offers several advantages and disadvantages that may significantly affect your business operations and financial health. Heres a detailed look at the pros and cons of operating as a C corporation. Tax implications A C corporation allows the business to be treated and taxed separately from you as the principal owner.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CPA Practice

FEBRUARY 19, 2025

The beneficial ownership reporting roller coaster that has been ongoing for the past two months because of various lawsuits is finally pulling into the station after a federal district court in Texas on Feb. 17 lifted the final nationwide injunctionthat had put the mandatory small business filings on hold since last December.

MyIRSRelief

FEBRUARY 21, 2025

Running a business in Los Angeles comes with its fair share of challenges, and one of the most daunting can be navigating the complexities of Californias Employment Development Department (EDD) payroll tax requirements. For business taxpayers facing EDD employment payroll tax controversies, the stakes are high. Unpaid back taxes, EDD audits, penalties, and unresolved tax issues can lead to financial strain, legal complications, and even the risk of business closure.

Acterys

FEBRUARY 19, 2025

At Acterys, we believe in fair competition, and we welcome comparisons that allow potential clients to make informed decisions. However, when competitors resort to spreading misinformation and misleading claims, its essential to address these inaccuracies head-on. Recently, we’ve encountered false narratives about our solution from some competitors.

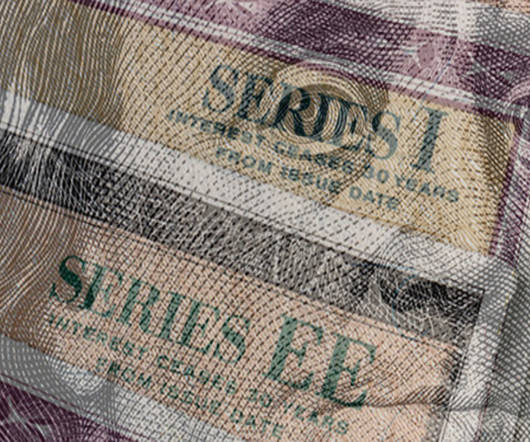

RogerRossmeisl

FEBRUARY 16, 2025

When considering the advantages of U.S. Treasury savings bonds, you may appreciate their relative safety, simplicity and government backing. However, like all interest-bearing investments, savings bonds come with tax implications that are important to understand. Deferred interest Series EE Bonds dated May 2005 and after earn a fixed rate of interest.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Going Concern

FEBRUARY 17, 2025

Announced February 13 , the AICPA and NASBA are giving up the quixotic fight to maintain 150 hours of education as the sole standard across CPA jurisdictions and are now “advancing model legislative language that enables an additional path to CPA licensure.” As has already been made law in Ohio recently , the alternate pathway option doesn’t eliminate 150 hours entirely, rather gives aspiring CPAs another option.

CPA Practice

FEBRUARY 15, 2025

The CPA Practice Advisor Weekly Tax News Roundup is a weekly recap of tax-related news from the past week. From IRS news and tax court cases, to state, SALT, legislation and other related areas, the roundup can help you catch-up on recent changes. Let us know if you like this new feature using the.

GrowthForceBlog

FEBRUARY 21, 2025

8 min read February 21st, 2024 For many small and medium-sized enterprises (SMEs), the end of the fiscal year coincides with the end of the calendar year. This means it is time for financial leaders to begin closing the financial books. Key Takeaways Reconcile Transactions and Accounts: This step in the process can be tedious because you have to look through minute details while paying exceptional attention to detail.

RogerRossmeisl

FEBRUARY 16, 2025

Intangible assets, such as patents, trademarks, copyrights and goodwill, play a crucial role in todays businesses. The tax treatment of these assets can be complex, but businesses need to understand the issues involved. Here are some answers to frequently asked questions. What are intangible assets? The term intangibles covers many items. Determining whether an acquired or created asset or benefit is intangible isnt always easy.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

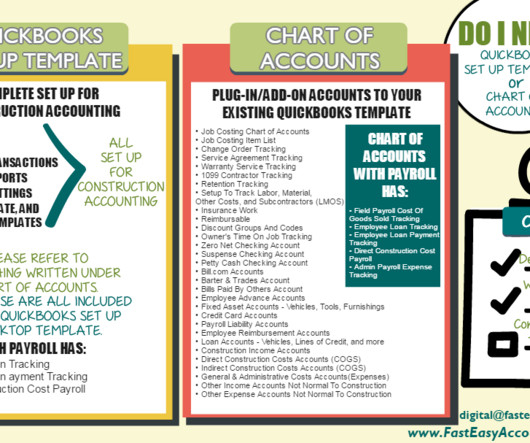

Randal DeHart

FEBRUARY 21, 2025

If you've been a long-time reader or a contracting company owner, you've probably heard about " Cost of Goods Sold " (COGS). But what does it really mean, and why is it crucial for your construction business's success? Understanding COGS isn't just about accountingit's about making smart decisions for profitability, pricing, and more. 1. What is the Cost of Goods Sold (COGS)?

Withum

FEBRUARY 21, 2025

The regulatory landscape is constantly evolving, and cybersecurity is no exception. You may have heard that under the new administration, regulation was going to be reduced or that there was a pause in enforcement actions, e.g. FCPA. These pauses are temporary and intended for the agencies involved to revise their approach to be efficient and effective.

BurklandAssociates

FEBRUARY 18, 2025

Strategies and best practices to help your biotech startup attract top talent, build a strong team, and drive innovation for long-term success. The post A Founders Guide to Building a Biotech Dream Team appeared first on Burkland.

VJM Global

FEBRUARY 17, 2025

Held by the Honble High Court of Andhra Pradesh In the matter of Tirumala Balaji Marbles And Granites vs. the Assistant Commissioner St and Others (W.P.No.1200/2025) The Petitioner applied for GST registration in the state of Andhra Pradesh. However, the proper officer rejected the application because the applicant and the authorized representative do not belong to the state of AP.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Going Concern

FEBRUARY 19, 2025

Fresh off the tipbox this morning: PwC has quietly killed off their women’s consulting experience after sending folks nationwide last week to recruit for it. Partners and WCE leads are in the dark after the application process was removed from all websites. People are thinking it is due to shrinking the scope of our DEI initiatives. Our tipster tells us the webpage was pulled last Saturday with no explanation.

Withum

FEBRUARY 19, 2025

Rev up for the Winter 2025 issue of Dealer Vision ! This edition is fully-loaded with the insights and strategies to keep your dealership running at peak performance. Inside, explore key takeaways from the AICPA Dealership Conference, master the art of implementing a strategic parts matrix, and discover the advantages of a cost segregation study. Inside This Issue The Future of Automotive Retail: Insights From the 2024 AICPA Dealership Conference Authored by: Vin Banek ; Jen Moylan , Lead Consul

Menzies

FEBRUARY 17, 2025

Menzies LLP - A leading chartered accountancy firm. What is the trading allowance? The trading allowance is a tax-free allowance of up to 1,000 per year for any trading or casual income sources. Sometimes referred to as the hobby allowance, the trading allowance is great for people who are just starting out a trade or receive small revenues for small gigs such as occasional dog walking.

Canopy Accounting

FEBRUARY 19, 2025

Kristy Busija, CEO & Founder of Next Conversation Consulting, and host Nicole McMillan, SVP of People at Canopy, explore the evolving landscape of hiring and talent retention in the accounting profession. They emphasize the need for modernized recruitment strategies and flexible work models to attract top talent. Kristy urges companies to meet candidates where by embracing fractional employees and building a culture that reflects flexibility, inclusion, and transparency.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

CPA Practice

FEBRUARY 20, 2025

To avoid mistakes and potential processing delays, taxpayers should refrain from filing until they have received all necessarytax documents. Taxpayers should always carefully review documents for inaccuracies or missing information.

Withum

FEBRUARY 19, 2025

For automotive accountants and CFOs, the AICPA Dealership Conference is the ultimate destination to connect with industry contacts, clients, and fellow accounting firms to discuss the latest hot topics and trends for the current and upcoming year. We at Withum look forward to attending year after year and highly recommend this event to our clients, banking partners, and other accounting firms.

Anders CPA

FEBRUARY 17, 2025

March 26, 2025, 11:00 am 12:00 pm (CST) Regulation CC, implementing the Expedited Funds Availability (EFA) Act, has been amended by the Board of Governors of the Federal Reserve System (Board) to increase threshold amounts effective July 1, 2025. Banks and credit unions should prepare for the upcoming changes while also reviewing hold policies and processes.

Reckon

FEBRUARY 20, 2025

The deadline for the new tax reporting requirements for Not For Profit (NFP) organisations with an active ABN is set for 31st March 2025. However, the new reporting scheme has left some NFPs uncertain of their status or tax obligations. Announced in 2021, the Australian government imposed the new self-reporting requirements to ensure that only eligible NFPs can access income tax exemption.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content