Becoming an Accounting Firm of the Future: The Benefits of Embracing New Technology

Insightful Accountant

DECEMBER 27, 2023

The Bonadio Group's Jennifer Wood takes a deep dive into the benefits of embracing new technology today.

Insightful Accountant

DECEMBER 27, 2023

The Bonadio Group's Jennifer Wood takes a deep dive into the benefits of embracing new technology today.

Going Concern

DECEMBER 27, 2023

Today is December 27, assuming there is no accounting firm in the entire country shitty enough to lay people off just days before the end of the year (a generous assumption), we should be able to tally up how many people were shown the door in 2023. These are U.S. numbers for Big 4 and mid-tier firms only, if we missed some get in touch. Also, these layoff numbers include only layoffs that were A) confirmed and B) counted by the firm as layoffs, meaning this year’s aggressive PIP usage and

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AccountingDepartment

DECEMBER 26, 2023

Small and medium-sized businesses (SMBs) are essential to the economy, accounting for more than half of all jobs worldwide. In recent years, several trends have impacted how SMBs operate, and we can expect even more changes to come in 2024. To prepare for the future, businesses must be aware of these shifts and adapt accordingly. In this blog post, we will discuss five SMB trends that we can expect to see in 2024, dealing with AI, customer experience, sustainability, and cybersecurity.

CPA Practice

DECEMBER 27, 2023

By Adam Lean, Co-Founder & CEO, The CFO Project. In my role as CEO of The CFO Project , a community that helps accountants start and scale CFO/Advisory practices, I’ve noticed that many accounting and bookkeeping firm owners are stuck in what we call The Accountant’s Trap. What is the Accountant’s Trap you might ask? It’s where financial professionals are trapped working long hours for low fees, are forced to deal with high-demanding clients,while being burnt out on compliance and transactio

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Accounting Today

DECEMBER 26, 2023

The Internal Revenue Service is not expected to meet the Treasury Department's goal of scanning millions of returns by the end of the year.

Insightful Accountant

DECEMBER 27, 2023

One less excuse for Desktop Users when it comes to migrating to QBO. There is now Balance Sheet Budgeting available in QBO Plus and QBO Advanced.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

DECEMBER 27, 2023

Here's how artificial will really impact accountants and what to do about it.

Going Concern

DECEMBER 26, 2023

The following post about a rowdy accounting firm holiday party was originally published on December 17, 2014. For more reading on holiday parties of yore, see this r/accounting thread from six years ago: Christmas Party Stories. My Firm Holiday Party is a Teaching Moment For What Not to Do at a Firm Holiday Party By Leona May One year at my firm, we had a Christmas party at the nicest hotel in the city.

Accounting Today

DECEMBER 26, 2023

The bottom state in the ranking received a total score for financial literacy of 51 out of 100.

TaxConnex

DECEMBER 28, 2023

The new year will no doubt be another active one in sales tax. Let’s look at a few of the likeliest developments. Weaker state revenue The kind of year it’s going to be for state coffers could greatly influence such future sales tax trends as new levies, tougher nexus thresholds and intensifying audits. If so, watch out for 2024. “With more fiscal data coming in, the long-term health of state budgets looks murky,” writes analyst Lucy Dadayan on the site of the Tax Policy Center.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

BurklandAssociates

DECEMBER 26, 2023

Thank you to all the experts throughout the startup ecosystem who joined our Startup Success podcast in 2023 to share knowledge and insights. The post Listeners’ Favorites: Our Top Podcast Episodes of 2023 appeared first on Burkland.

MyIRSRelief

DECEMBER 29, 2023

Employment taxes can be a complex area for businesses, especially when it comes to Form 941, the Employer’s Quarterly Federal Tax Return. This form is used to report income taxes, social security tax, or Medicare tax withheld from employee’s paychecks, and to pay the employer’s portion of social security or Medicare tax. However, mistakes can happen, and when they do, they can lead to significant tax problems.

Accounting Today

DECEMBER 29, 2023

Accounting Today's annual survey reveals firms' expectations, worries and plans for the next 12 months.

Going Concern

DECEMBER 28, 2023

I’m breaking my holiday vacation with this news: Attention all CPA Exam Candidates… pic.twitter.com/YwBD3uym2l — NASBA (@NASBA) December 27, 2023 Make sure you check out the comments. The funniest part is they posted this on Tuesday like everything was going to be normal: #CPAExam candidates! Waiting for your score(s)? They will be released tonight at 7 p.m.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

CPA Practice

DECEMBER 28, 2023

By Christopher Stark, Founder & CEO, Cetrom. ChatGPT ushered in a new era of automation in accounting (link goes to YouTube), for better or worse. While technology has made many content-based tasks much easier, questions remain about its accuracy and security. This machine learning-powered chatbot with the GPT-3 engine at its core has captivated people’s attention with its rapidly evolving ability to interpret questions and commands to produce generally coherent natural-language responses.

Patriot Software

DECEMBER 29, 2023

Aggressive promotion, scams, and ERC mills—that’s the drama surrounding the employee retention credit (ERC). The ERC was a lifeline for small businesses struggling to stay open during the pandemic. But bad actors quickly pounced on the opportunity.

Accounting Today

DECEMBER 27, 2023

Technology developers who serve the accounting profession share the developments they have planned for 2024.

Going Concern

DECEMBER 29, 2023

It’s here! The barely anticipated year-end phoning in of content look back on what news was important to Going Concern readers and Google visitors in 2023. This ranking is derived from analytics data thus is more trustworthy than the editorial team trying to remember what story was big back in March. While you’re here, let us say thanks for reading and we’ll see you in 2024.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

CPA Practice

DECEMBER 29, 2023

In the 2024 presidential election year, you may have another important election to consider, although this one is on your personal tax return. Depending on your situation, you might elect to forgo preferential tax treatment on certain long-term capital gains and qualified dividends in favor of deducting investment interest expenses. Background : Generally, the tax law allows you to deduct the investment interest expenses you incur during the year—for example, when you buy stock on margin— but on

Insightful Accountant

DECEMBER 26, 2023

What better time of the year to find out what you are thinking.ProAdvisors are invited to January's "open microphone' edition of QB Talks to tell us what you think about the ProAdvisor Awards, the ProAdvisor Program and recent QB-Desktop news.

Accounting Today

DECEMBER 27, 2023

The Internal Revenue Service's Exempt Organizations and Government Entities unit has published two new technical guides aimed at nonprofits.

Going Concern

DECEMBER 25, 2023

It’s Christmas, why are you even here? THERE’S NO ACCOUNTING NEWS. Now go forth and be merry. Love, GC p.s. if your nieces or nephews mention Skibidi Toilet at dinner tonight do yourself a favor and don’t Google it. I’ve been stuck in a YouTube hole for the last two days, send help. The post A Brief Message From Santa appeared first on Going Concern.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

CPA Practice

DECEMBER 25, 2023

Organizations have increasingly been drawn into societal conversations around social change, and are often expected by some to take action, while others may express irritation at such moves by businesses. But according to a new survey from The Conference Board, fewer than half of U.S. workers (44%) are satisfied with their organization’s response to social change issues like racism and gun violence.

AccountingDepartment

DECEMBER 29, 2023

We are thrilled to announce that Episode 9 of our podcast, Beyond the Books , is now live and ready for your listening pleasure.

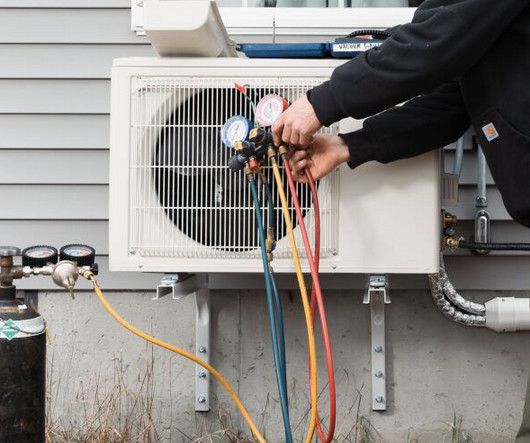

Accounting Today

DECEMBER 26, 2023

Federal money is keeping construction businesses busy, but comes with its own complications.

Insightful Accountant

DECEMBER 26, 2023

According to the recently released Intuit QuickBooks Entrepreneurship in 2024 Report, nearly a quarter of US consumers are considering starting a new business in 2024.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Randal DeHart

DECEMBER 29, 2023

To be in business and to remain in business, become a business person! To run a business, you must be business-like. It's not sufficient just to be very good at what you do. Many people who are 'very good at what they do' have failed. The familiar cry: "I'm far too busy for that" is no excuse. Are you 'too busy' to be a competent businessperson? If so, your construction business won't last long.

AccountingDepartment

DECEMBER 28, 2023

Each year, our team gears up to attend events all over the United States that AccountingDepartment.com proudly sponsors. As a proud supporter of Vistage International, Entrepreneurs’ Org, EOS Worldwide, CEO Coaching International, Genius Network, Small Giants Summit, HubZone, Women Presidents’ Organization, and B2B CFO®, our team gets to experience many great events, meet many amazing people, and see our clients from all over.

Accounting Today

DECEMBER 29, 2023

The Internal Revenue Service and Treasury plan to propose regulations on a requirement for a product identification number, and they're asking for comments ahead of time on the PIN requirement.

CPA Practice

DECEMBER 28, 2023

Jeff Ostrowski Bankrate.com (TNS) Many people view debt as the financial enemy and strive to pay it down as quickly as possible. That strategy is a wise one for high-interest obligations like credit card balances, but when it comes to mortgages , the math isn’t as clear-cut. You might be better off putting those payoff funds toward investing, some experts say, while others believe it’s better to unload your debt, then focus on investments.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Let's personalize your content