Deadlines galore: One of the biggest challenges of sales tax

TaxConnex

APRIL 7, 2022

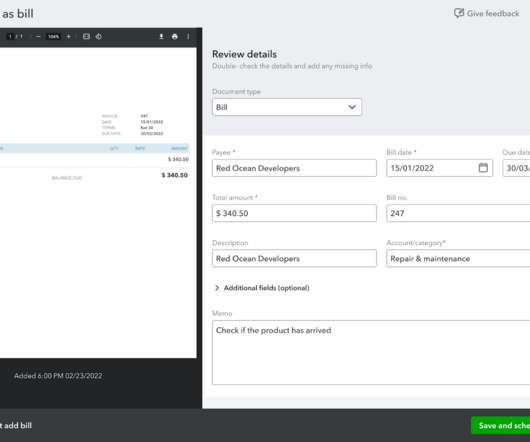

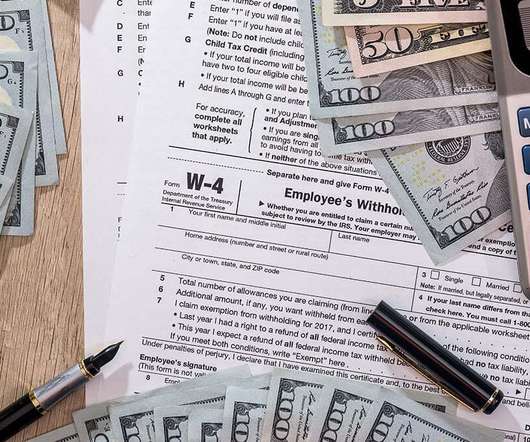

Federal Income Tax Day, April 18 th , looms large in everybody’s mind right now. Too bad sales tax doesn’t come with a deadline that simple. State sales tax filing obligations come in a dizzying number of deadlines for you to follow (potentially with bad consequences if you don’t). And generally, the higher the volume of tax you’ll be reporting, the more often you have to file.

Let's personalize your content