IRS warns tax pros to beware of identity theft

Accounting Today

JULY 2, 2024

The Internal Revenue Service issued a warning to tax professionals to be on guard against the identity thieves who are targeting them and their clients.

Accounting Today

JULY 2, 2024

The Internal Revenue Service issued a warning to tax professionals to be on guard against the identity thieves who are targeting them and their clients.

Canopy Accounting

JULY 1, 2024

CAS firms focus on advisory accounting services rather than a compliance-heavy service. But, what exactly is it? Learn more below! By now, you’ve probably heard of CAS, CAAS, advisory accounting, accounting and advisory services—or whatever you want to call it! This trend in the accounting industry transitions to a focus on advisory accounting services rather than a compliance-heavy service.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Ryan Lazanis

JULY 4, 2024

ChatGPT has taken the digital world by storm. Discover how this revolutionary AI chatbot can enhance accuracy and efficiency in your firm. The post ChatGPT Accounting: 13 Ways Accountants Can Use ChatGPT Now appeared first on Future Firm.

AccountingDepartment

JULY 4, 2024

Growing a business can be an exhilarating experience, but it comes with its fair share of challenges. One crucial area that requires meticulous attention is accounting. Proper accounting practices are the backbone of financial stability and growth, yet many small to medium-sized businesses (SMBs) often overlook them.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

SkagitCountyTaxServices

JULY 3, 2024

The barcode is so commonplace you kind of forget that it was the cutting edge of retail technology once upon a time. Now, you probably only think about it when you scan it at the register (BEEP). But this year is, in fact, its 50th anniversary. But, as commonplace as the barcode is, it’s facing an upgrade, aka the QR code — the more sophisticated, more informative, and more interactive improvement on the everyday barcode.

Accounting Today

JULY 1, 2024

The IRS and Treasury Department released final regulations on how companies and tax pros should report and pay the 1% excise tax on corporate stock repurchases.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

CPA Practice

JULY 3, 2024

By Brad Barkin Small accounting and financial services firms are facing escalating operation threats and vulnerabilities. Cybercrime is on the rise, with PwC reporting a 30% higher risk of cybersecurity attacks for financial firms. Additionally, accounting, tax preparation, and bookkeeping firms are navigating a growing staffing shortage. Technology can address both of these problems, from improved cybersecurity platforms to artificial intelligence-based tools to take over the routine processes

Accounting Today

JULY 1, 2024

Here's how to go beyond routine process automation and apply strategies that bolster efficiency, autonomy and value for the controllership function.

CPA Practice

JULY 1, 2024

CPA firm leaders that view their multigenerational workforce as a source of competitive advantage have the right outlook. Sure, it can be challenging to create a cohesive and productive work environment when you have four or even five different generations working in your organization. But harnessing the strengths of each group, from the Silent Generation to Generation Z, can create significant upside for your business — and help position your firm for future success.

BurklandAssociates

JULY 2, 2024

As our special 100th episode approaches in September, we look back at inspiring stories and insights from the first half of 2024. The post Startup Success – Highlights from the Past 6 Months of Our Podcast Series appeared first on Burkland.

Speaker: Dave Sackett

Traditional budgeting and forecasting methods can no longer keep pace with today’s rapidly evolving business environment. Static budgets, rigid annual forecasts, and outdated financial models limit an organization’s ability to adapt to market shifts and economic uncertainty. To stay ahead, finance leaders must leverage a future-forward approach—one that leverages real-time data, predictive analytics, and continuous planning to drive smarter financial decisions.

Going Concern

JULY 2, 2024

The other day, BDO USA released a press release entitled “BDO Strengthens Audit Quality Commitment with Addition of Second Independent Member on Audit Quality Advisory Council ,”the content of which strongly suggests that their next Public Company Accounting Oversight Board (PCAOB) inspection is going to be hot garbage. No, not suggests.

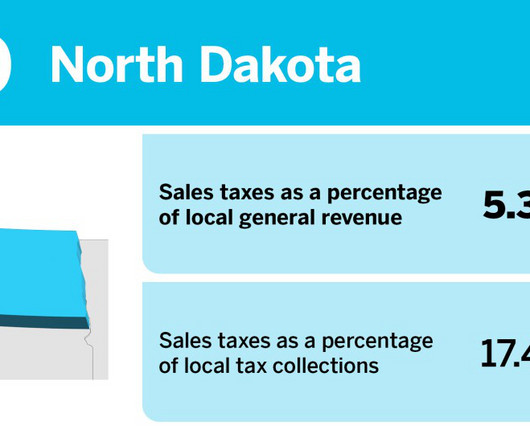

Accounting Today

JULY 3, 2024

Where does sales tax drive the most local revenue?

CPA Practice

JULY 2, 2024

By Sandi Smith Leyva. One of my favorite ways to use ChatGPT is for suggesting titles for articles, blogs, and email subject lines. Of course, it can also write articles, blog posts, email event notices, client correspondence, and social media posts, to name a few. In this article, I’ll focus on its ability to write good titles and subject lines as well as end with a somewhat creative approach to generating blog posts.

ThomsonReuters

JULY 2, 2024

The recent surge in artificial intelligence advancements has started to transform the professional services industry, and corporate tax departments are no exception. Generative Artificial Intelligence ( GenAI ) presents a game-changing opportunity to transform corporate tax operations by enhancing human capabilities and driving strategic decision-making.

Speaker: Erroll Amacker

As businesses increasingly adopt automation, finance leaders must navigate the delicate balance between technology and human expertise. This webinar explores the critical role of human oversight in accounts payable (AP) automation and how a people-centric approach can drive better financial performance. Join us for an insightful discussion on how integrating human expertise into automated workflows enhances decision-making, reduces fraud risks, strengthens vendor relationships, and accelerates R

Going Concern

JULY 1, 2024

On November 15, 2023, EY announced then-Regional Managing Partner, EY Americas Financial Services Organization (FSO) Janet Truncale would be taking the reins from departing EY Global Chair and CEO Carmine Di Sibio and the baton would be officially handed off July 1. As in today. It was a given that Carmine, an enthusiastic promoter of the Project Everest plan to split audit and consulting practices , would probably make an exit after the much-hyped plan was shelved last April.

Accounting Today

JULY 5, 2024

Whether there will be a next generation of accountants is, in many ways, up to all of us.

CPA Practice

JULY 2, 2024

By Sarah Lynch, Inc. (TNS) Companies are hiring—but in some cases, they might only be pretending to. Four in 10 companies have posted a fake job in the last year, according to 649 hiring managers in a recent survey from the job-seeking site ResumeBuilder.com. Some posted just a handful, while others—13 percent—posted 75 or more. Today, eight in 10 of companies that have posted a fake job posting still have one actively listed.

Wellers Accounting

JULY 5, 2024

Chris Thompson speculates off the 2024 UK General Election result how the newly elected Labour government could raise taxes.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Going Concern

JULY 2, 2024

I’m in the middle of a tedious admin project that involves digging back through our archive to update old posts I’ve long forgot about and one such forgotten post I stumbled across was this: Some Guy Made a Bangin’ Cover of the IRS Hold Music and You Need to Hear It Some Guy Made a Bangin’ Cover of the IRS Hold Music and You Need to Hear It Seeing that post reminded me that some months ago, we were informed of yet another — perhaps even superior — remix of IRS hold

Accounting Today

JULY 5, 2024

Huselton, Morgan and Maultsby's Student Leadership Program aims to steer more students into accounting — and prepare them for other decisions down the line.

CPA Practice

JULY 2, 2024

Tax practitioners continue to be targeted on a daily basis by cybercriminals whose objective is to steal their clients’ data so they can file fraudulent tax returns that better impersonate their victims and are harder to detect, the IRS warned on July 2. Through the spring, IRS stakeholder liaisons had received reports of nearly 200 tax professional data incidents potentially affecting up to 180,000 clients.

Insightful Accountant

JULY 2, 2024

Intuit is offering QuickBooks Bill Pay Elite to ProAdvisors and QBO-Accountant firms at no cost. We always want you to know when Intuit is offering a perk.

Speaker: Anna Tiomina, MBA

AI is reshaping industries, yet finance remains one of the slowest adopters. Concerns over compliance, legacy systems, and data silos have made finance teams hesitant to embrace AI-driven transformation. But delaying adoption isn’t just about efficiency—it’s about staying competitive in a rapidly evolving landscape. How can finance leaders overcome these challenges and start leveraging AI effectively?

Going Concern

JUNE 29, 2024

Earlier this week, a recruiter told me a story about a job seeker who was already employed but looking to jump elsewhere. She interviewed with a firm that really loved her and they were eager to hire her immediately but in the end she declined their offer saying she talked it over with the firm she was with and decided to stay. Clearly her firm had sweetened the pot to entice her to stick around.

Accounting Today

JULY 2, 2024

The end of Chevron deference, shifting IRS policies, and other major changes to the tax landscape.

CPA Practice

JULY 5, 2024

IRS Commissioner Danny Werfel recently dropped by the studios of NBC10 in Boston to talk about tax scams, the agency’s Direct File tax-filing software, and how the IRS is trying to reach a younger audience via social media. That led to a discussion about Werfel’s cat, Emmett. Why? “We have just now started to put my cat Emmett out there as the expert on tax scams,” Werfel said during the interview.

Canopy Accounting

JULY 1, 2024

Darren Root will be sitting down with Canopy CEO Davis Bell to discuss the future of accounting and most of all, answering your questions. You can submit questions for Darren as part of the registration process for the webinar.

Speaker: Joe Wroblewski, Senior Sales Engineer

Is your tech stack working for you—or are you working for it ? 🤖 In today’s world of automation and AI, technology should simplify workflows—not add complexity. Seamless integration and interconnectivity are key to maximizing productivity, optimizing workflows, and improving collaboration. Join expert Joe Wroblewski for a practical and insightful session on how you can build a smarter, more connected tech stack that drives efficiency and long-term success!

Patriot Software

JULY 5, 2024

When you start a business, do you just wing it? Or, do you take time to plan and research your strategies before you jump into the market? If you’re like most entrepreneurs, you probably prepare your business before taking the plunge.

Accounting Today

JULY 3, 2024

The job market continued to grow last month, but wage growth slowed, ADP reported.

CPA Practice

JULY 1, 2024

The Treasury Department and the IRS issued the much-anticipated final regulations on cryptocurrency broker reporting requirements June 28, after receiving more than 44,000 public comments on the proposed rules last fall. The regulations require brokers to report certain sale and exchange transactions that take place beginning in calendar-year 2025 on the soon-to-be released Form 1099-DA.

ThomsonReuters

JULY 3, 2024

In a landmark decision, the Supreme Court overturned the longstanding Chevron doctrine, significantly altering the landscape of federal agency authority. The ruling, known as the Loper decision , marks a seismic shift in how federal agencies interpret and enforce statutes. Checkpoint Payroll Update recently spoke with Alexander T. MacDonald, Shareholder and member of the Workplace Policy Institute at Littler, to understand how the Loper decision may affect federal labor and employment law.

Speaker: Melissa Hurrington

Finance isn’t just about the numbers. It’s about the people behind them. In a world of constant disruption, resilient finance teams aren’t just operationally efficient. They are adaptable, engaged, and deeply connected to a strong organizational culture. Success lies at the intersection of people, culture, adaptability, and resilience. Finance leaders who master this balance will build teams that thrive through uncertainty and drive long-term business impact.

Let's personalize your content