Ensuring Your Firm’s Future with Smart Technology Choices

CPA Practice

JANUARY 20, 2025

The pace of change in the accounting industry will never slow down, and technology will continue to be a primary driver of that change.

CPA Practice

JANUARY 20, 2025

The pace of change in the accounting industry will never slow down, and technology will continue to be a primary driver of that change.

Insightful Accountant

JANUARY 20, 2025

The current landscape presents a prime opportunity for launching your own tax practice, with retiring baby boomer CPAs creating market gaps and technology reducing startup costs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

RogerRossmeisl

JANUARY 21, 2025

Business valuation experts often rely on prospective financial statements when applying the discounted cash flow (DCF) method to value a private business interest. However, when management prepares financial projections for another purpose such as a loan application repurposing them to estimate fair market value for litigation purposes may raise a red flag.

AccountingDepartment

JANUARY 21, 2025

Financial reporting has always been a critical pillar of effective business management. It's the roadmap that guides decisions, uncovers opportunities, and highlights risks. However, in a fast-evolving economic landscape, relying solely on monthly reports or quarterly financial statements is slowly becoming obsolete.

Speaker: Danny Gassaway and Wayne Richards

Finance leaders are prioritizing efficiency and digital transformation, yet many hesitate to automate due to uncertainty. Without a clear understanding of its impact, organizations risk falling behind competitors who are leveraging automation to drive productivity and cost savings. Join Wayne Richards and Danny Gassaway from AvidXchange for a practical guide on bringing accounts payable (AP) automation to your organization.

Accounting Today

JANUARY 21, 2025

Affected taxpayers now have until Oct. 15 to file and pay their taxes, matching the federal relief from the IRS.

BurklandAssociates

JANUARY 21, 2025

Accurate accounting for R&D expenses is critical for compliance and can have significant tax benefits as well as financial reporting and operational implications. The post Accounting for R&D Costs in a Biotech Startup: Why Its Important to Get it Right appeared first on Burkland.

Accountant Advocate brings together the best content for small business accounting professionals from the widest variety of industry thought leaders.

Accounting Today

JANUARY 22, 2025

Charles Hoffman believes the accounting industry is poised for a major shift toward machine-understandable artifacts and semantic knowledge graphs.

Reckon

JANUARY 22, 2025

Its a new year for businesses across Australia, and you may be looking to jump-start the engine that once ran smoothly in 2024. With 12 months ahead of you, the best way to get underway is through proper planning with a roadmap. For any roadmap, it is important to have clear and achievable goals for your business, with key dates and goals that will motivate you for the year ahead.

Accounting Today

JANUARY 22, 2025

More states are expected to simplify their sales tax laws and leverage artificial intelligence for doing tax audits, according to a new report from Avalara.

RogerRossmeisl

JANUARY 21, 2025

Understanding how to deduct transportation costs could significantly reduce the tax burden on your small business. You and your employees likely incur various local transportation expenses each year, and they have tax implications. Lets start by defining local transportation. It refers to travel when you arent away from your tax home long enough to require sleep or rest.

Advertisement

It's the time of year to give our close process some TLC. Join us in this one hour webinar where we discuss how to adopt leading practices and infuse technology into the month-end close process to improve our experience and increase our productivity during month-end and quarter-end close. Learning Objectives: This course's objective is to understand how the month-end close can be improved with automation and adoption of leading practices.

TaxConnex

JANUARY 21, 2025

An exemption certificate is one of the most useful tools that your online company has for sales tax. This little piece of paper is used to exempt an otherwise taxable transaction from sales tax. The overall concept is that the end user incurs sales tax and that all sales of tangible personal property are taxable unless specifically enumerated, usually in legislation.

CPA Practice

JANUARY 24, 2025

For now, business information ownership reporting requirements under the Corporate Transparency Act remain voluntary despite the U.S. Supreme Court on Thursday overturning an order from a Texas federal appeals court in December that had halted mandated BOI report filing with FinCEN.

Accounting Today

JANUARY 21, 2025

KPMG US has set up a subsidiary that has filed an application in Arizona to establish a law firm in the state, with hopes of going national.

RogerRossmeisl

JANUARY 21, 2025

Medicare health insurance premiums can add up to big bucks especially if youre upper-income, married, and you and your spouse both pay premiums. Read on to understand how taxes fit in. Premiums for Part B coverage Medicare Part B coverage is commonly called Medicare medical insurance. Part B mainly covers doctors visits and outpatient services. Eligible individuals must pay monthly premiums for this benefit.

Speaker: Jennifer Hill

Payroll compliance is a cornerstone of business success, yet for small and midsize businesses, it’s becoming increasingly challenging to navigate the ever-evolving landscape of federal, state, and local regulations. Mistakes can lead to costly penalties and operational disruptions, making it essential to adopt advanced solutions that ensure accuracy and efficiency.

TaxConnex

JANUARY 23, 2025

A new construction project, a renovation or expansion of a property, ongoing management of a property: All these and more can come with a ton of sales tax nuances. Particularly for those construction companies with projects beyond the borders of their home state, where they may have done well with sales tax compliance for many years. For sales tax purposes, a contractor is generally an entity or person engaged in the construction, alteration or improvement of real property.

CPA Practice

JANUARY 18, 2025

Clients just starting out need insight on which legal structure to select for their business. Seasoned entrepreneurs may need insight as their company grows and the entity once selected may not be as advantageous as it once was. The New Year is an ideal time to get a refresh on business entity options for your clients.

Accounting Today

JANUARY 24, 2025

Plus, FloQuast achieves ISO 42001 certification on AI systems; and other accounting tech news and updates.

GrowthForceBlog

JANUARY 22, 2025

8 min read January 21st, 2024 Every nonprofit leader has a duty to be a responsible, honest, and trustworthy steward of their financial resources. Key Takeaways Foster Financial Transparency: The need for financial transparency in a nonprofit is paramount. Not only does financial transparency support and strengthen donor trust, but it also creates accountability.

Speaker: Sierre Lindgren

Fraud is a battle that every organization must face – it’s no longer a question of “if” but “when.” Every organization is a potential target for fraud, and the finance department is often the bullseye. From cleverly disguised emails to fraudulent payment requests, the tactics of cybercriminals are advancing rapidly. Drawing insights from real-world cases and industry expertise, we’ll explore the vulnerabilities in your processes and how to fortify them effectively.

Withum

JANUARY 20, 2025

Employment taxes are always scrutinized by the IRS and state taxing authorities, particularly in the healthcare industry. Audit issues include reclassification of workers from independent contractor to employee; an individual receiving both a Form W-2 and Form 1099 in the same calendar year; incorrect employment tax forms preparation; the failure to issue Forms 1099; and general non-compliance with Form W-9 record-keeping.

CPA Practice

JANUARY 21, 2025

The IRS updated frequently asked questions about the Energy Efficient Home Improvement Credit and the Residential Clean Energy Property Credit inFact Sheet 2025-01 on Jan. 17.

Accounting Today

JANUARY 24, 2025

KPMG appoints new global head of audit; Weaver launches health care advisory practice; and more news from across the profession.

AccountingDepartment

JANUARY 23, 2025

For entrepreneurs and SMB owners, accounting is the backbone of a healthy business. Without accurate and reliable accounting practices, even the most successful companies can find themselves in turmoil.

Speaker: Debra L. Robinson

CPAs know the drill: taxes, compliance, rinse, repeat. But what about the sneaky cash flow that’s quietly messing with your organization’s success? It’s time to step into the spotlight and expose the “dirty little secrets” of cash flow to fuel strategic growth. By upskilling your accounting practices and shifting focus from tax compliance to the strategic movement of money, you can transform your role from reactive accountant to proactive financial strategist.

Going Concern

JANUARY 23, 2025

Last year the Institute of Chartered Accountants in England and Wales (ICAEW) put together a report on the state of mid-tier firms across the pond based on a survey of managing partners that we covered in two parts: Heres How Mid-Tier Accounting Firms Are Feeling About Private Equity and M&A Heres How Mid-Tier Accounting Firms Are Feeling About the Talent Crisis and Remote Work The excerpt below is from the first one that covered private equity and mergers/acquisitions : [M]any firms in the

CPA Practice

JANUARY 18, 2025

Users in the U.S. have reported that the popular social media site TikTok has gone offline as of Saturday evening (Jan. 18, 2025). The app was at the center of a recent U.S. Supreme Court case that involved a law passed by Congress last year.

Accounting Today

JANUARY 23, 2025

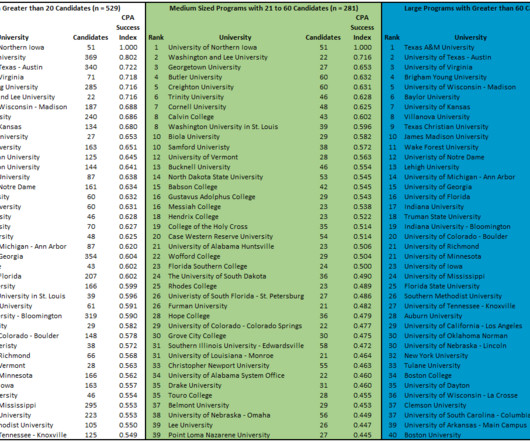

These institutions serve as examples of how academic structure, focused preparation and student support can help graduates successfully navigate the CPA exam.

IgniteSpot

JANUARY 22, 2025

Whether youre considering an in-house hire or an outsourced firm like Ignite Spot, these 10 questions will help you find the best fit for your business.

Speaker: Aaron Berson

Managing spend is more than a cost cutting exercise – it's a pathway to smarter decisions that unlock efficiency and drive growth. By understanding and refining the spending process, financial leaders can empower their organizations to achieve more with less. Explore the art of balancing financial control with operational growth. From uncovering hidden inefficiencies to designing workflows that scale your business, we’ll share strategies to align your organization’s spending with its strategic g

Going Concern

JANUARY 21, 2025

We knew it was only a matter of time before someone filed a class action lawsuit against BDO USA for all that ESOP stuff. Pretty much ever since the secret partner meeting happened back in 2023 we’ve heard from countless current and former partners saying “Gee I wish someone would sue the s**t out of BDO” (paraphrasing) for everything related to BDO’s deal with Apollo and the ESOP.

CPA Practice

JANUARY 20, 2025

The order requires Equifax to comply with federal law, and Equifax must pay a $15 million civil money penalty, which will be deposited into the CFPBs victims relief fund.

Accounting Today

JANUARY 23, 2025

The Securities and Exchange Commission has rescinded a Staff Accounting Bulletin on safeguarding cryptocurrency assets that had been criticized by the industry and even by some of its own commissioners.

Withum

JANUARY 21, 2025

Let’s examine the withholding requirements for 401(k) plan distributions. Distribution Withholding Requirements A participant may receive a distribution from their vested account balance when one of the following below occurs: Participant reaches the age of 59 The participant dies, becomes disabled, or terminates employment The Plan terminates and no successor defined contribution plan is established or is maintained by the Plan Sponsor The participant has a financial hardship and the Plan

Advertisement

Bleisure travel — where employees combine work and leisure — has been around since the advent of corporate travel and is here to stay. Successful bleisure policies strike a balance between employee preferences and company goals — workers report a 64% improvement in work-life balance, while companies benefit from reduced travel costs and increased workforce innovation.

Let's personalize your content