How Mike Habib, EA Collaborates with CPAs and Lawyers for Tax Representation Referrals

MyIRSRelief

DECEMBER 13, 2024

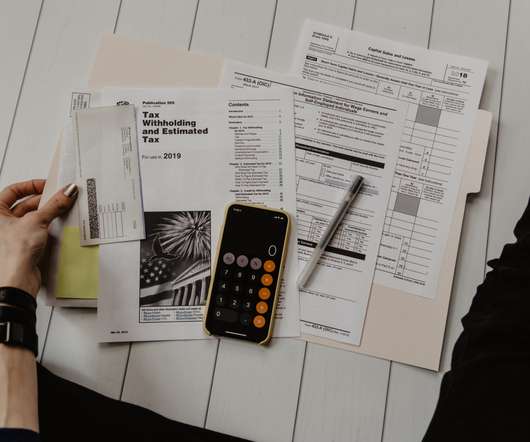

Focus on Core Work: CPAs can concentrate on financial statements, financial assurance, tax preparation and planning, while lawyers can focus on legal strategies, knowing their clients tax issues are in capable hands. Joint Webinars: Host educational events to attract and inform potential clients.

Let's personalize your content