Should Tax Planners Work with Family Offices? How Family Offices Work

CTP

OCTOBER 28, 2024

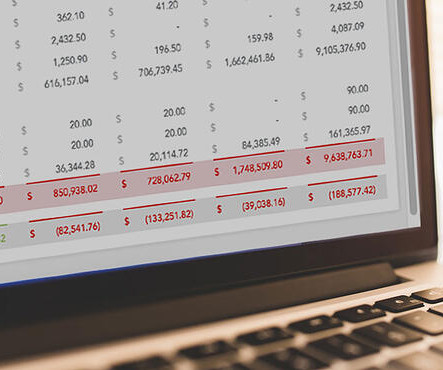

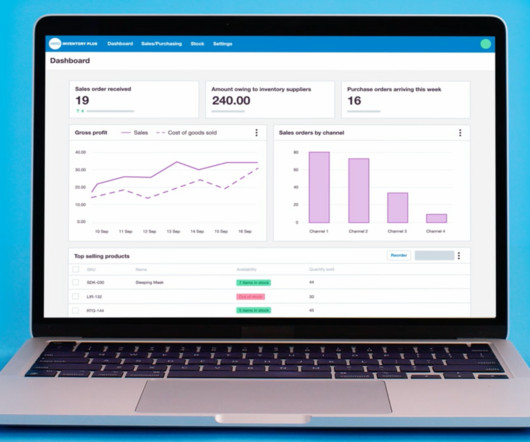

Administrative & Financial Support Moving into the realm of finances, a family office may handle bookkeeping, legal and estate planning oversight, cash flow management, financial advice, insurance management, accounting and tax filing oversight, and charitable giving management.

Let's personalize your content