Avalara Unveils Intelligent Tax Content Solution for Lodging and Hospitality

CPA Practice

NOVEMBER 20, 2024

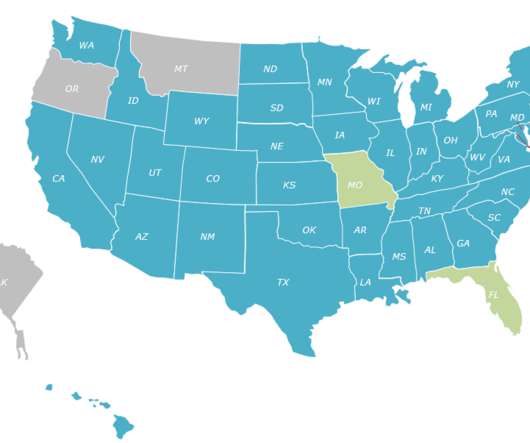

a provider of tax compliance automation software for businesses of all sizes, has announced new and innovative efficiencies for the lodging and hospitality sectors, with the release of Avalara Tax Content (ATC) for Lodging. Avalara, Inc. ,

Let's personalize your content