In 2025, the Social Security Wage Base is Going Up

RogerRossmeisl

OCTOBER 27, 2024

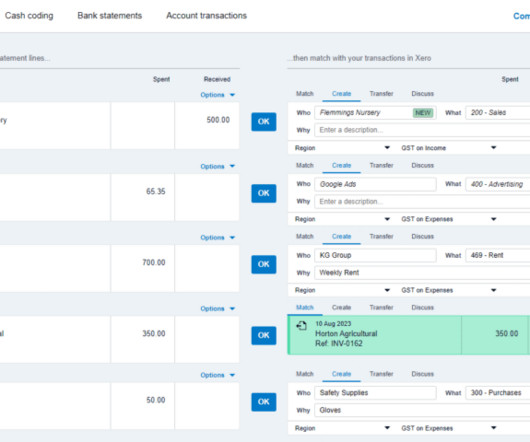

If your business has employees, you may need to budget for additional payroll costs, especially if you have many high earners. One is for Old Age, Survivors and Disability Insurance, which is commonly known as the Social Security tax, and the other is for Hospital Insurance, which is commonly known as the Medicare tax.

Let's personalize your content