Using an Income Tax Preparation Service: Is It Worth the Cost?

MyIRSRelief

JANUARY 16, 2023

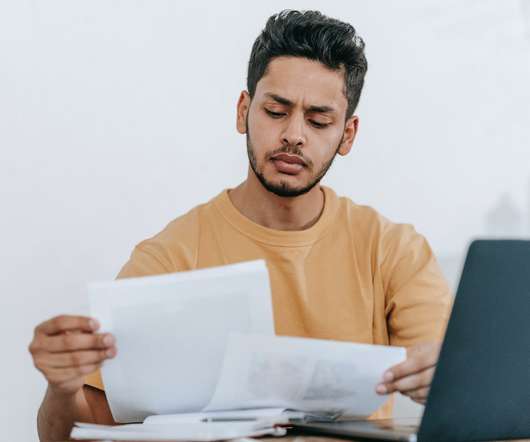

When it comes to tax season, many people are faced with the decision of whether to prepare their own taxes or use an income tax preparation service. While it may seem like an added expense, there are many benefits to using a professional tax preparation service that make it well worth the cost.

Let's personalize your content