Sales tax and nonprofits

TaxConnex

SEPTEMBER 7, 2023

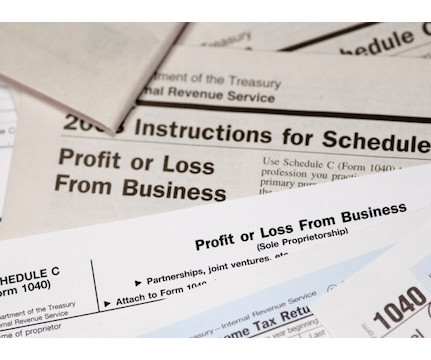

They also frequently sell TPP such as merchandise, memberships, books and so forth that for-profit companies generally have to charge and collect sales tax on. Are non-profits exempt from sales tax obligations? But as always with sales tax, rules vary state to state. That depends on many factors.

Let's personalize your content