How to File a Deceased Person’s Final Income Tax Return

CPA Practice

MARCH 1, 2023

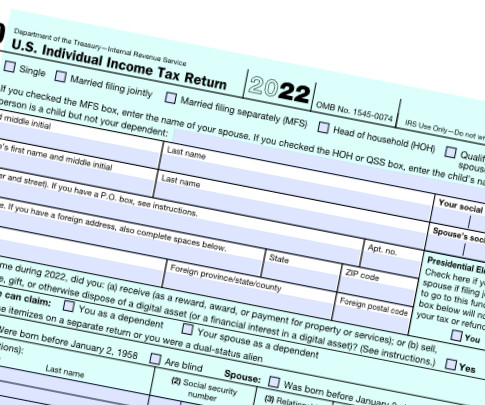

But what about when death and taxes coincide, such as when someone dies during the year and has a tax filing obligation? Unfortunately, when someone is deceased, the decedent’s personal representative is generally required to file any final tax returns for the deceased person. 31, 2022, you can file a joint 2022 return.

Let's personalize your content