Beyond the LLC: Alternate Business Structures in 2024

CPA Practice

FEBRUARY 23, 2024

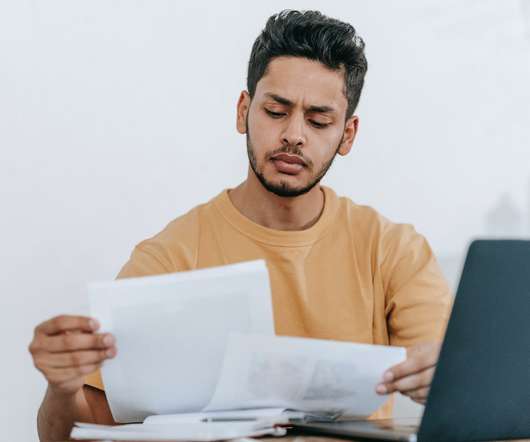

An S Corp must report corporate income, losses, and deductions through its shareholders/owners, and in turn, the shareholders/owners report company income on their personal income tax returns. Lastly, owners who perform “substantial work” as employees must adhere to payroll tax requirements. corporation.

Let's personalize your content