IRS Suggests All Taxpayers Get IP PIN for More Security When Filing Taxes

CPA Practice

OCTOBER 23, 2024

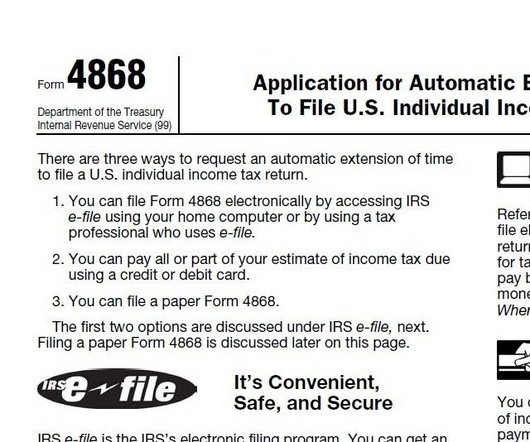

This simple yet crucial step can provide an added layer of security, helping protect against tax-related identity theft. The IRS encourages taxpayers to sign up for IRS Online Account , which provides a quick and easy way to obtain an IP PIN. Once an IPPIN is issued, it must be on both electronic and paper returns.

Let's personalize your content