Tax Season Got Off to a Rough Start in Oregon

CPA Practice

FEBRUARY 2, 2023

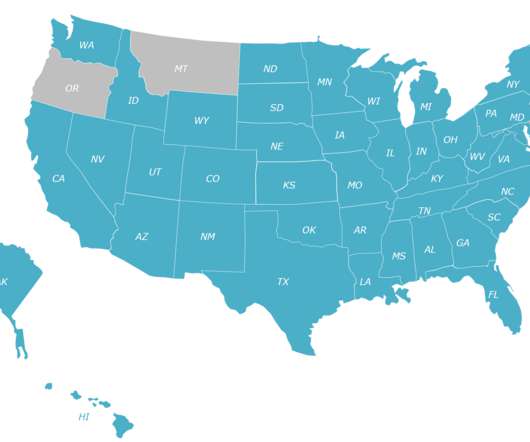

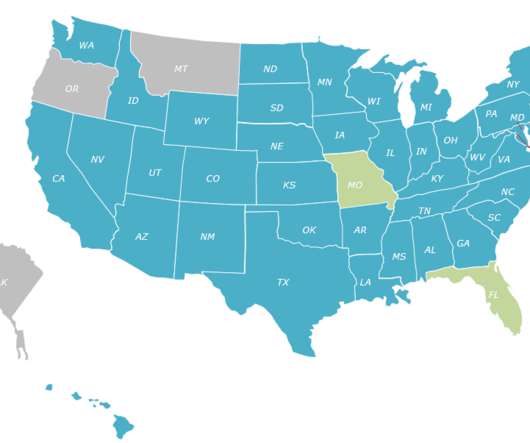

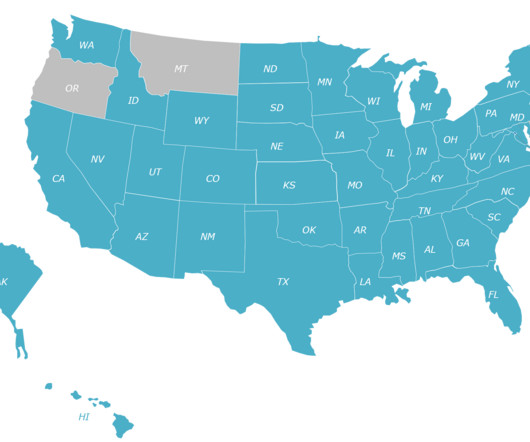

By Jeff Manning, oregonlive.com (TNS) The Oregon Department of Revenue acknowledged Thursday that it sent personal tax refund information for about 5,000 taxpayers to the wrong address. All 5,000 are intended for, and were mailed to, Portland residents, said Robin Maxey, a spokesperson for the department.

Let's personalize your content