Tax Problem Resolution in the Inland Empire, CA

MyIRSRelief

APRIL 22, 2024

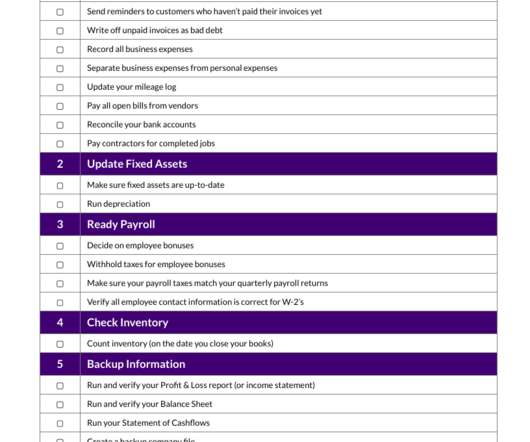

Navigating tax issues can be daunting, especially when facing audits, unpaid taxes, or payroll problems. This FAQ guide provides insights into common tax problems and solutions available in Corona, CA. Discuss Payment Options: If you owe taxes, discuss payment options with your advisor. What should I do?

Let's personalize your content